ECONOMIC UPDATE FROM OUR PRESIDENT, JONATHAN CASTELEYN:

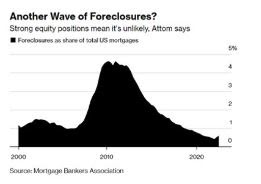

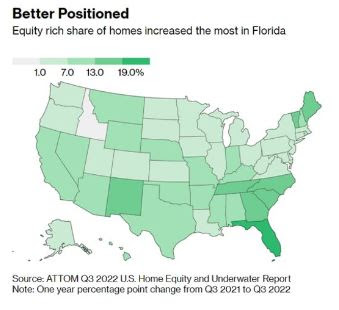

No Turkey Like 2008 Because of Housing EquityFirst off, Happy Happy Thanksgiving to you and yours. There is always something to be thankful for, so hopefully your list is long. Despite our cautious articles over recent weeks, there is no 2008 Real Estate Market Crash coming solely because of one item…Housing Equity. Even if we see a drop in home values during 2023 as a result of an aggressive Fed, home owners have enough built up equity to weather the storm. The share of mortgage borrowers who are “equity-rich” — meaning that they owe no more than half of the property’s market value — increased to 48.5% last quarter, according to a report by Attom, a real estate data firm. The figure was 48.1% in the second quarter of 2022, and 39.5% a year ago. The pandemic-era housing boom has delivered windfall wealth gains for millions of Americans over the past two years. That’s a potential cushion now that home prices have turned around and are expected to fall further as the Federal Reserve ramps up interest rates. The American Enterprise Institute’s Housing Center predicts a nationwide drop of as much as 15% by the end of next year. The number of home-equity lines of credit, or HELOCs, issued in the second quarter of 2022 rose by 43% from the previous year, according to Attom. In the housing bubble that preceded the 2008 financial crisis, loose lending standards meant that many borrowers had virtually no equity in their homes. When the market crashed, millions of Americans were forced into foreclosure. Out of 58.1 million outstanding mortgages in the US, only about 227,100 homeowners were facing possible foreclosure as of last quarter and out of that at-risk group, 92% had at least some equity built up in their homes. There is always a silver lining in every Market downturn and American Housing Equity is something to be thankful for this Holiday season. |

|

|

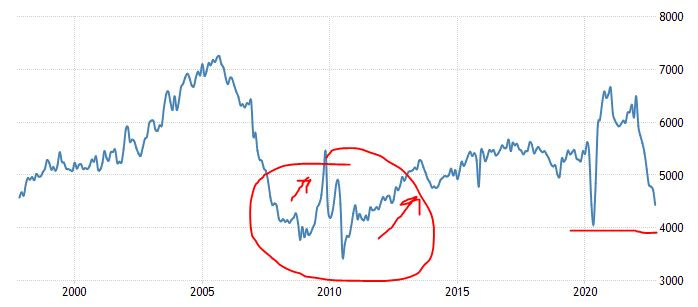

Getting Closer To A Bottom In ActivityExisting Home Sales in the US tumbled 5.9% to a seasonally adjusted annual rate of 4.43 million in October of 2022 as reported this week, the lowest since December of 2011 (with the exception of a very brief fall at the beginning of the pandemic in 2020). It was the ninth straight month of falling sales as home prices remained elevated and a 30-year fixed mortgage rate hit a 20-year high pushing many buyers out of the market. “The impact is greater in expensive areas of the country and in markets that witnessed significant home price gains in recent years”, said NAR Chief Economist Yun. Meanwhile, the total housing inventory fell 0.8% to 1.22 million units. The median existing-home price for all housing types was $379,100, up 6.6% from October 2021. Properties typically remained on the market for 21 days in October 2022, up from 19 days in September last month. Putting our analytics hat on here at Liberty Title, we notice that the bottom in Housing Activity over the past 25 years occurs at or near the 4.00 million adjusted annual rate in Existing Home Sales, so we think a rebound in activity is near. This will coincide with a dropping of 30 year mortgage rates as discussed in our article last week as we think the Federal Reserve’s rate hiking campaign to tame inflation is coming to an end (with likely only a single rate hike coming in mid December before pausing for 2023). The 25 Year Chart of Existing Home Sales Seasonally Adjusted: |

|

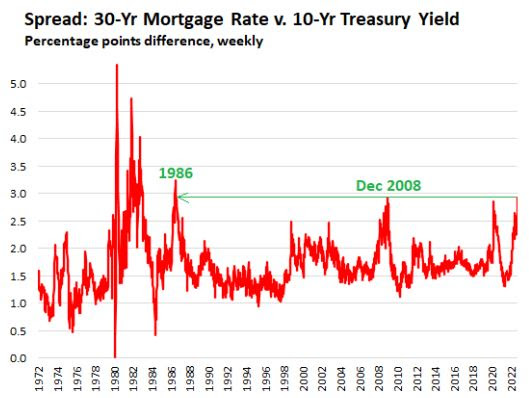

What Is Happening With 30 Year Mortgage Rates? Why Almost The Doubling Since The End Of 2021?The cost of locking in a mortgage is an important facet of the American Dream and a vital part of the real estate industry. Thus, the doubling of 30-year mortgage rates in 2022 (with a spike since June) is an important principle to understand. 30 year mortgage rates tend to run parallel with 10-year Treasury yields (but at a spread higher over Treasuries). This makes sense because the 10-year Treasury is an all-weather beacon of the most current cost of money reflecting credit conditions, inflation, and demand for funds. The 30-year fixed mortgage then trades at a spread over the 10-year as this bond obviously has 20 additional years of debt service and a different debtor (a mortgagor versus the US government standing behind the credit worthiness of Treasuries). Now the almost doubling of 30-year fixed rate mortgages from 3.5% at the start of this year to almost 7.0% has been more a function of the spread over Treasury widening versus a movement higher in 10 year Treasuries (said another way, 30-year rates are moving higher faster than 10-year Treasuries are moving higher). This spread widening is a function of banks and mortgage lenders raising their cost to borrow faster than the government, because banks are concerned that there is less clarity as to what value they are underwriting to. All mortgages are struck on a loan-to-value ratio and banks are concerned that real estate values are going to start to go down and thus are demanding higher interest rates (return on capital) in advance. The current spread between 10-year Treasuries and 30-year Mortgages is now at 2.92%, matching the multi-year high last seen on December 31, 2008 (and also inline with levels last seen in 1986). See our chart from Freddie Mac. Our conclusion is that we expect that 30 year mortgage rates will start coming down, as this decade+ high in spread over Treasury normalizes as banks get more comfortable in the new environment. This will coincide with lower real estate prices as we have discussed in recent articles. |

|

We Wanted To Help Our Investor Clients And Our Realtors With Investor Clients:We have identified a solid lending outfit that solely focuses on extending loans to Investors including Fix and Flip strategies and clients that Buy to Rent out their properties. Please contact Jonathan at Liberty Title to be introduced to our contact at LendingOne, a 100 person lending operation that has extended us a dedicated loan officer for our Treasure Coast clients and beyond. General terms for LendingOne’s products include: For Fix and Flip:

For Rental Loans:

|