ECONOMIC UPDATE FROM OUR PRESIDENT, JONATHAN CASTELEYN:

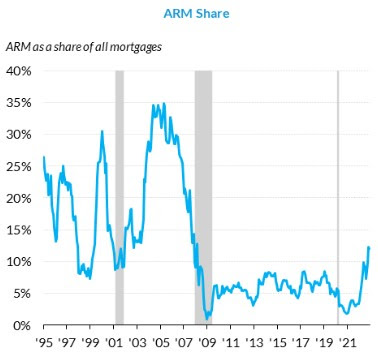

ARMS or “Buy Downs” Picking Up SteamAdjustable rate mortgages are back although they are called something else these days. As mortgage interest rates rise, adjustable-rate mortgages (ARMs…now repackaged as the “Buy Down”) become more popular, and they now make up 12.0 percent of total mortgage production, up from 3.3 percent in November 2021. Among mortgages originated from 1995 to 2004, the average ARM share was 18.3 percent so even this recent spike up to low double digit total loan share is still below average. When mortgage rates are attractive, ARM share is low, because borrowers want to lock in their rates for 30 years. When rates are less attractive, ARMs allow borrowers to save money given the lower rates, and the borrower can refinance if rates drop. So is there greater risk for the new ARM consumer or “Buy Down” customer? The short answer is No. The risks of ARMs were substantially mitigated by the regulatory reforms put in place after the 2008 bust. After the financial crisis, the CFPB implemented an ability-to-repay rule, essentially requiring that mortgages be fully amortizing (versus prior ARM products which were just interest only) and that the lender qualify the borrower at the highest rate they could experience in the first five years. Lenders now hold ARM borrowers to higher lending standards than borrowers who take out fixed-rate mortgages, requiring higher credit scores, higher incomes, and larger down payments to compensate for the higher risk.The result? Very few ARMs have a reset period shorter than five years. ARMs are no longer something to fear—in fact, they could help borrowers save money and reduce barriers to homeownership. |

|